Explore 15 Key Difference between Cheque and Bill of exchange

In the realm of financial transactions, two essential instruments often take the center stage: the cheque and the bill of exchange. While they may seem similar at first glance, it is crucial to recognize their fundamental disparities. So, let us embark on a journey of exploration, unraveling the 15 key difference between Cheque and Bill of exchange.

15 Difference between Cheque and Bill of exchange

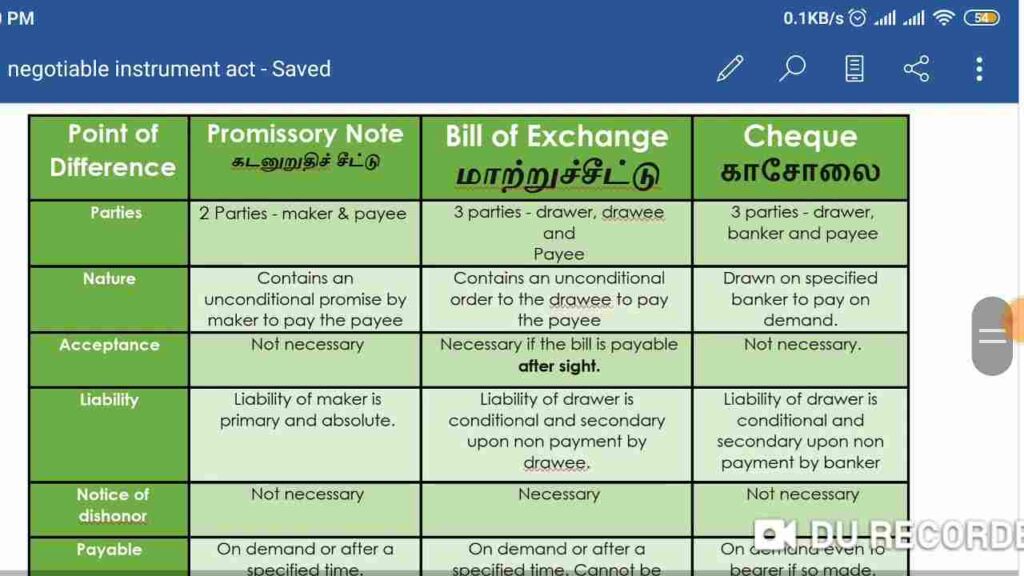

Nature: A cheque is a negotiable instrument that allows money to be moved between accounts, usually within the same bank. A bill of exchange, on the other hand, acts as a written directive from the creditor to the debtor, ordering the payment of a specific sum on a given date.

Three parties are involved in a cheque: the drawer, who is the account holder, the drawee, who is the bank, and the payee, who is the recipient. A bill of exchange, on the other hand, consists of four parties: the endorser (optional), the drawer (creditor), the drawee (debtor), and the payee (creditor or third party).

Liability: In the case of a cheque, the bank is primarily responsible for fulfilling the payment. A bill of exchange, on the other hand, places the primary obligation for payment on the drawee (debtor).

Legal Status: The Negotiable Instruments Act governs checks primarily, whereas the Bills of Exchange Act and other laws, including the Negotiable Instruments Act, govern bills of exchange.

A cheque is payable immediately upon demand or within a predetermined period of time, typically six months. However, the parties to a bill of exchange agree on a specific maturity date.

Acceptance: A cheque is deemed accepted by default when it is issued, so the drawee is not required to accept it. A bill of exchange, on the other hand, needs to be accepted by the drawee in order to be effective.

A cheque must be presented for payment within a reasonable amount of time after it has been issued. A bill of exchange, on the other hand, must be presented for acceptance and payment within a certain time frame.

Cheques can be crossed, which means they have two parallel lines on them, either with or without the words “and Co.” The payment will only be credited to the payee’s account thanks to this feature. However, a bill of exchange cannot be crossed.

When a cheque is dishonoured, the bank notifies the payee by sending a notice. In contrast, a bill of exchange requires the holder to notify the parties involved of dishonour before taking any action.

Usage: Routine transactions like salary payments, bill settlements, and retail purchases are frequently carried out with checks. In commercial transactions, international trade, and credit agreements, bills of exchange are frequently used.

Cheques are typically exempt from stamp duty. On the other hand, bills of exchange require stamp duty, which varies based on the amount mentioned.

The drawer of a cheque has the right to revoke or cancel it at any time prior to presentation. A bill of exchange, on the other hand, cannot be revoked by the drawer after it has been issued without the holder’s permission.

Set-off: In the case of a cheque, the bank is permitted to offset the payment made against any unpaid debt that the drawer may still owe. With a bill of exchange, this set-off is not possible.

There is no specific notice needed when a cheque is assigned to a third party. A bill of exchange, on the other hand, demands written notice of any assignment or transfer to the drawee.

Compensation: The payee may offset the amounts owed against one another in the event that the same drawer issued multiple checks. Bills of exchange, however, are not covered by this offset clause.

Understanding these difference between cheque and bill of exchange is essential for individuals, businesses, and financial institutions alike. By grasping the nuances of these distinct financial instruments, one can navigate the intricate world of monetary transactions with confidence and precision.